Zapier has long been a name whispered with admiration in tech circles, thanks to its innovative approach to workflow automation. Founded over a decade ago, the company has quietly built a reputation as a leader in no-code solutions that help businesses and individuals streamline their operations. As it continues to grow, questions about its future plans have naturally emerged, particularly regarding the possibility of an initial public offering (IPO). This article delves into everything you need to know about Zapier's potential public debut, examining its current status, financials, and market positioning.

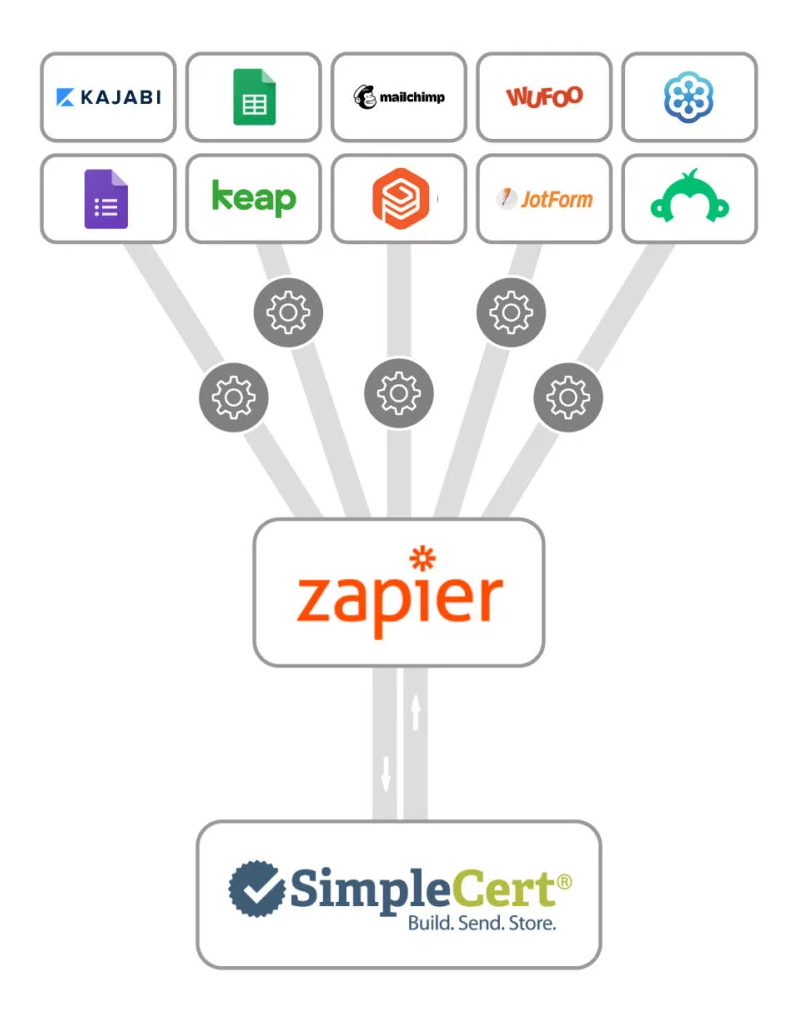

For those unfamiliar, Zapier offers a platform that connects various apps and services, allowing users to automate repetitive tasks without needing coding skills. With millions of users and substantial annual revenue, the company has remained private, fueling speculation about when or if it will take the leap into public markets. This piece explores the latest developments surrounding a possible Zapier IPO, providing insights into what investors might expect should the company decide to go public.

While there is no concrete timeline for a Zapier IPO, the company's impressive growth and valuation make it a subject of keen interest among investors. Below, we analyze key statistics, including revenue, valuation, and market share, to paint a clearer picture of Zapier's standing in the tech industry. Additionally, we explore the implications of going public and what it could mean for both the company and its stakeholders.

Exploring Zapier's Financial Milestones

Zapier currently generates $310 million in annual revenue, a testament to its widespread adoption and utility across industries. This figure highlights the company's ability to monetize its no-code automation solutions effectively, catering to both individual users and enterprises. With over 3 million users and more than 100,000 paying customers, Zapier has established itself as a dominant player in the workflow automation space.

The company's valuation stands at an impressive $5 billion, reflecting investor confidence in its business model and growth trajectory. Despite this, Zapier has chosen to remain private, eschewing traditional funding routes in favor of self-sustained expansion. This strategic decision underscores the company's focus on long-term value creation rather than short-term gains often associated with public listings.

As Zapier continues to expand its user base and refine its offerings, its financial performance remains a key indicator of its readiness for an IPO. Investors eagerly await any updates from the company regarding its future plans, particularly given the growing demand for cloud-based automation solutions in today's digital landscape.

Assessing the Potential for Public Listing

Despite its success, Zapier has yet to announce concrete plans for an IPO. The company's leadership has adopted a cautious stance, emphasizing that while an IPO is not off the table, it is not an immediate priority. This approach aligns with Zapier's history of prioritizing organic growth and maintaining control over its operations without external pressures.

Investors interested in acquiring Zapier stock currently have limited options, as the company remains privately held. Pre-IPO marketplaces offer some opportunities to purchase shares, but these transactions are typically limited and come with inherent risks due to the lack of transparency and regulatory oversight. For now, those hoping to invest in Zapier must rely on speculative channels until an official announcement is made.

Should Zapier decide to pursue a public listing, it would likely attract significant attention from institutional and retail investors alike. The company's strong financials and proven track record position it well for a successful IPO, though timing will be crucial given the current volatility in the tech sector.

Evaluating Investment Opportunities

Platforms like Hiive provide a glimpse into the pre-IPO world, offering investors the chance to buy and sell shares of companies like Zapier before they go public. These platforms serve as a bridge between private companies and eager investors, albeit with certain limitations. While they allow early access to potentially lucrative opportunities, the scarcity of data and unpredictable nature of pre-IPO markets can pose challenges.

For those considering investing in Zapier, understanding the dynamics of private equity and the potential risks involved is essential. Pre-IPO shares may offer attractive returns if the company performs well post-listing, but they also carry the risk of underperformance or delays in going public. As such, thorough research and due diligence are critical components of any investment strategy.

Looking ahead, the prospect of owning Zapier stock through a public offering presents exciting possibilities. Investors who follow the company's progress closely will be better positioned to capitalize on any opportunities that arise, whether through pre-IPO platforms or a formal stock exchange listing.

Insights from Venture Capital Investments

Sequoia Capital's recent acquisition of shares in Zapier underscores the startup's appeal to top-tier venture capitalists. Despite its elusive nature, the company has managed to maintain financial independence, relying on organic growth rather than external funding. This unique position has allowed Zapier to operate without the typical constraints faced by startups seeking capital injections.

The investment by Sequoia highlights the broader trend of enterprise software firms attracting significant interest from investors. Automation tools like Zapier cater to a growing demand for efficiency-enhancing technologies, making them highly attractive targets for venture capital firms. However, Zapier's reluctance to seek funding reflects its confidence in its business model and operational capabilities.

As the tech IPO market remains sluggish, companies like Zapier face a delicate balancing act between sustaining growth and preparing for a potential public debut. Their ability to navigate these challenges will play a pivotal role in determining their future success and influence in the industry.

Ranking Among Top Cloud Computing Companies

Included in Forbes' prestigious Cloud 100 list, Zapier ranks among the best private cloud computing companies globally. This recognition further solidifies its reputation as a leader in the automation space, alongside other trailblazers like Postman. With a valuation of $5 billion, Zapier demonstrates the immense potential of cloud-based solutions in transforming how businesses operate.

The inclusion in the Cloud 100 list serves as validation of Zapier's impact on the tech industry, showcasing its innovation and adaptability in an ever-evolving market. AI-driven advancements continue to reshape the cloud computing landscape, and Zapier's commitment to staying at the forefront ensures its relevance and competitiveness moving forward.

As the company considers its next steps, its presence on such esteemed lists reinforces its credibility and strengthens its position as a viable candidate for a future IPO. Investors and industry observers alike will watch closely as Zapier navigates this pivotal phase in its development.

An Overview of Zapier's Company Profile

Zapier's profile on Crunchbase provides valuable insights into its operations, funding history, and overall standing in the tech ecosystem. As an IT company specializing in web application integrations, Zapier has carved out a niche for itself by enabling seamless workflows across thousands of apps. Its robust offerings have earned it a loyal customer base and a CB Rank that reflects its prominence in the industry.

Despite its success, Zapier has opted to remain private, avoiding the complexities associated with public listings. This decision allows the company to focus on strategic initiatives and long-term goals without the pressure of quarterly earnings reports. By maintaining its private status, Zapier retains flexibility in managing its resources and expanding its reach.

As the company continues to evolve, its Crunchbase profile will serve as a valuable resource for tracking its progress and understanding its contributions to the tech community. Whether through partnerships, product innovations, or eventual public listing, Zapier's journey promises to be one of continued growth and impact.