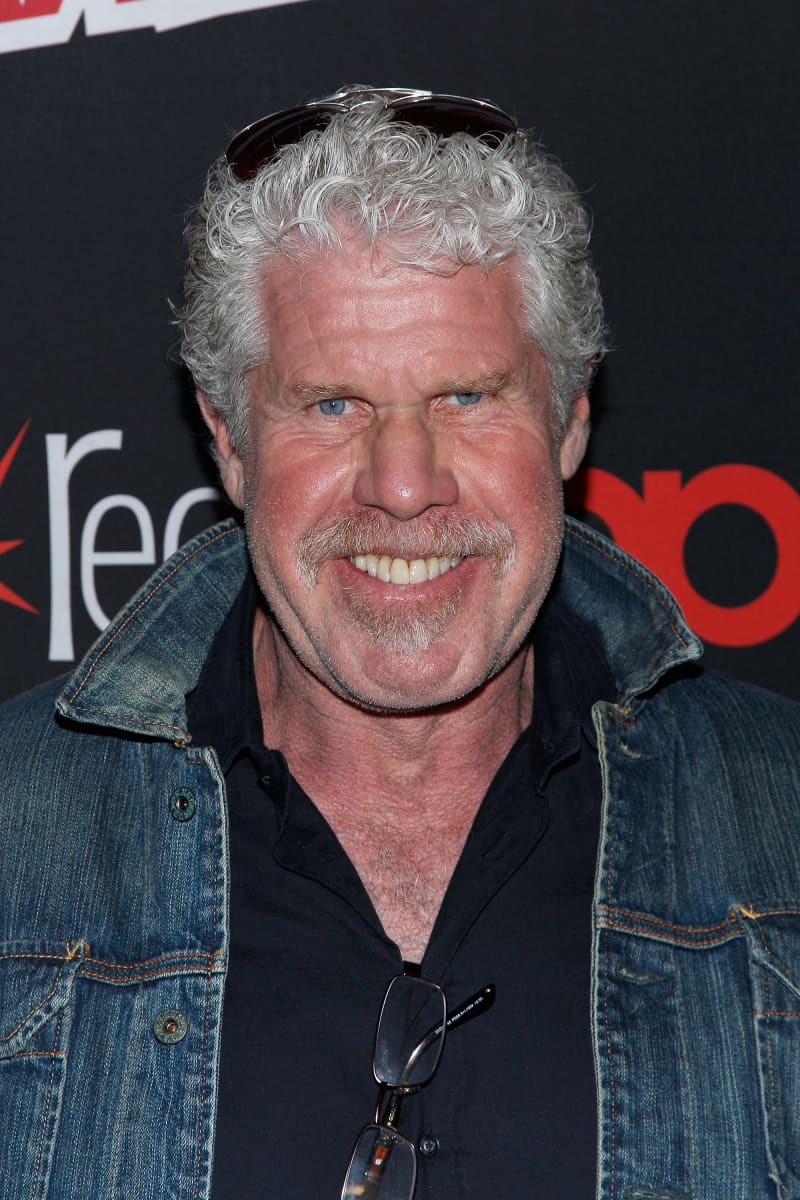

Ron Perlman, a name synonymous with both acting brilliance and business acumen, has carved out a unique space in Hollywood. Known for his commanding presence on screen and versatility as an actor, Perlman's career spans decades of iconic performances. However, beyond the glitz and glamour of Tinseltown lies a fascinating narrative about wealth accumulation and financial stewardship.

As we delve into Ron Perlman Net Worth 2023: The Surprising Wealth Behind the Hollywood Legend!, this exploration uncovers not just the numbers but also the strategic decisions that have shaped his financial landscape. This journey through Perlman's wealth is more than a mere tally of assets; it's a story of resilience, adaptability, and savvy investments that have contributed to his enduring legacy in the entertainment industry.

The Rise and Fall: A Journey Through Financial Peaks

Forbes estimates Ron Perelman's net worth at $1.9 billion, marking a significant shift from his once towering fortune of over $20 billion. This substantial decline underscores the volatile nature of high-stakes business ventures. Despite this, Perelman remains a formidable figure in the financial world, demonstrating that even after facing considerable setbacks, one can maintain a substantial wealth base.

His journey from being America's richest man to adopting a simpler lifestyle highlights the transient nature of immense wealth. Selling off art collections and scaling back philanthropic efforts are indicative of recalibrating priorities. Such moves reflect a pragmatic approach to preserving capital amidst economic uncertainties.

This transition serves as a cautionary tale for aspiring entrepreneurs and investors alike, emphasizing the importance of diversification and risk management in sustaining long-term financial health. Perelman's experiences provide valuable insights into navigating the complexities of wealth preservation in fluctuating market conditions.

Reassessing Priorities: A New Chapter in Leadership

While some sources suggest that Bloomberg's valuation of Perelman's net worth might be inflated, the billionaire himself acknowledges the need to reset priorities. Amidst managerial changes at MacAndrews & Forbes, questions arise concerning the conglomerate's future direction and Perelman's overall financial well-being.

In embracing a simpler life, Perelman signals a shift towards consolidating resources rather than expanding aggressively. This decision aligns with prudent financial strategies aimed at safeguarding existing assets against potential market downturns. It also indicates a willingness to adapt to changing circumstances, which is crucial for maintaining relevance in today's dynamic business environment.

Such introspection and adjustment underscore the necessity of continuous evaluation and adaptation in leadership roles. By reassessing personal and professional goals, Perelman exemplifies how seasoned executives can navigate challenging times effectively while preserving their core interests.

Building Blocks of Fortune: Insights into Wealth Creation

Ronald Perelman amassed a staggering $20 billion during his peak, primarily through shrewd acquisitions and innovative deal-making. His ability to identify undervalued companies and transform them into profitable enterprises showcases exceptional entrepreneurial skills. Understanding these strategies provides critical lessons for anyone interested in wealth creation.

Despite fluctuations in his net worth, Perelman continues to invest wisely across various sectors, including cosmetics and confectionery. These diversified holdings help mitigate risks associated with single-industry exposure, ensuring steady income streams regardless of economic cycles. Such foresight contributes significantly to his sustained financial success.

Furthermore, analyzing Perelman's investment patterns reveals the importance of timing and strategic planning in building lasting wealth. His knack for spotting opportunities before they become mainstream allows him to capitalize on emerging trends early, thereby maximizing returns on investment over time.

Facing Debts Head-On: Lessons in Financial Management

Ron Perelman faced mounting debts due to extensive borrowing for corporate expansions. Eventually, properties like his Fifth Avenue mansion, once symbols of opulence, were put up for sale. These actions illustrate the critical role debt management plays in maintaining financial stability.

By addressing liabilities proactively, Perelman demonstrates the value of confronting financial challenges directly. Selling high-value assets may seem drastic but often proves necessary when restructuring finances to achieve long-term sustainability. Such measures highlight the importance of liquidity in managing large-scale operations successfully.

This episode in Perelman's life offers invaluable lessons about balancing growth ambitions with fiscal responsibility. It reinforces the idea that even successful businessmen must remain vigilant about their financial obligations to avoid jeopardizing hard-earned wealth.

Artistic Ventures: Transforming Collections into Capital

Ron Perelman has sold nearly $1 billion worth of artworks, reflecting his strategic use of personal collections as financial instruments. This move not only generates immediate cash flow but also reduces holding costs associated with maintaining vast art repositories. Two notable pieces found new homes with renowned collector Ken Griffin, underscoring the appeal of Perelman's selections within elite circles.

Selling such prized possessions requires careful consideration, balancing sentimental attachment against practical financial needs. For collectors like Perelman, transforming artistic passion into monetary gain represents another facet of astute wealth management. It exemplifies how hobbies or interests can contribute meaningfully to overall financial portfolios.

This aspect of Perelman's financial strategy adds depth to understanding how diverse revenue streams enhance resilience against economic volatility. By leveraging non-traditional assets, individuals can create robust financial frameworks capable of weathering unforeseen storms.

Legacy and Continuity: Sustaining Wealth Over Time

From an estimated worth of $19.8 billion in 2018 to $1.9 billion by November 2022, Ronald Perelman's trajectory illustrates both the heights achievable through aggressive deal-making and the vulnerabilities inherent in concentrated wealth. As part of the 2025 Billionaires list, he ranks #2110, showcasing continued prominence despite reduced figures.

Perelman's legacy extends beyond mere numbers; it encompasses a philosophy of resilient entrepreneurship characterized by adaptability and innovation. His diverse holdings—from candy manufacturing to cosmetic production—highlight the significance of spreading risk across multiple industries to ensure longevity in wealth retention.

Looking ahead, Perelman's story serves as inspiration for future generations of entrepreneurs seeking sustainable paths toward prosperity. By studying his successes and setbacks, budding tycoons can glean essential wisdom about creating enduring legacies in an ever-evolving global economy.